More efficient, faster, safer? – The vision of the tokenized economy

By Alexander Bechtel

Blockchain technology and tokenization are expected to make financial services available around the clock and globally in the future. But before the vision of a tokenized economy can become reality, regulatory issues need to be clarified.

Imagine the smartest minds from business and research coming together for a weekend on the boardroom floor of the European Central Bank (ECB). With a view of the Frankfurt skyline, they would be tasked with devising an effective and efficient financial market infrastructure. Such a concept would have to address some weaknesses of the existing financial system: Financial services should be available around the clock, seven days a week in a digitalized world. Sending money and other assets should feel no more complicated and take longer than sending a text message – whether the transaction crosses national borders or not. To name just a few anachronisms of the existing system.

Fax machines and other relics of the pre-digital age would presumably no longer play a role in the experts’ proposed solution. In contrast, the blockchain would have good chances. After all, one of the great promises of the blockchain is to increase the efficiency of the financial market. Even if many of these promises are still more of a vision than a reality today, the technology is fascinating an ever larger part of society. This starts with demand from small investors for cryptocurrencies such as bitcoin, moves to large companies such as Siemens using the blockchain to issue bonds, and extends to central banks thinking about issuing money on the blockchain, or already doing so.

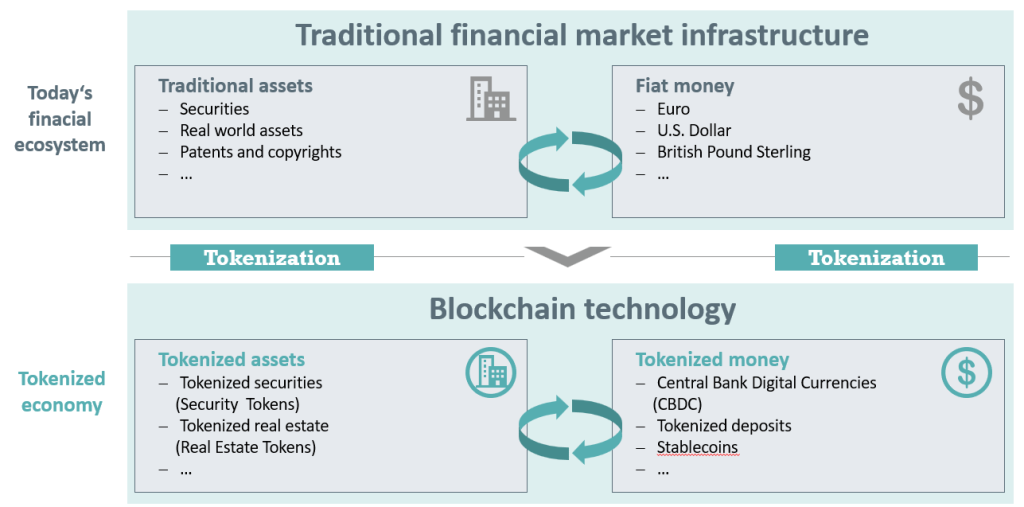

If you want to understand the new world of blockchain technology and its applications for the financial market, the best place to start is by looking at the existing financial system. There, in highly simplified terms, it is a matter of exchanging assets for money – for example, when buying a share, a property or a work of art.

The blockchain lifts this process into the digital space: In the context of so-called tokenization, assets and money are taken out of their previous environment and stored as a digital token on a blockchain. A share becomes an equity token, and real estate becomes a real estate token. Put simply, tokens are a digital title deed to the underlying asset or money. The blockchain takes on the role of the database that stores and manages information such as account balances. The blockchain-based database does not require an administrator. This means that account balances can be managed in a decentralized manner for the first time. From a computer science perspective, this is revolutionary and enables exciting new applications. However, a database without an owner – and thus without a responsible (legal) person – is giving regulators sleepless nights.

The regulatory concerns are valid and need to be answered and resolved before any real benefits of blockchain in everyday life. And it would be worth it, because tokenization would create fascinating opportunities for our financial market. Assets and money would be on the same platform for the first time in the history of our financial system. As an example, the equity token would be on the same platform as the cash token, and the two could thus be exchanged for each other quickly and easily. Genuine delivery-vs-payment transactions become possible. The susceptibility to errors is reduced and the speed of settlement increases. Counterparty and settlement risks are minimized if constant data reconciliation between different financial intermediaries is no longer necessary because they are all on the same platform. In today’s financial market, two completely independent ecosystems must first be linked for the exchange of money for shares: The stock is usually in physical form at a central securities depository, and the money sits in the account at the bank.

In addition to efficiency gains, blockchain technology also promises new applications. With so-called smart contracts, logic can be embedded in financial market transactions. This involves if-then relationships like a standing order: “If first day of the month, then execute a wire transfer.” Smart contracts also make arbitrarily complex logics conceivable that go far beyond what we know today. For example, a payment equipped with logic could mimic an insurance contract against weather risks: “If the temperature is below 0 degrees Celsius for more than 30 days between February 1 and March 31, 2024, and there is more than three liters of precipitation per square meter, then transfer amount X to account Y.”

So much for the theory. In practice, however, there are one or two challenges that mean that the vision of a tokenized economy has not yet become reality. What exactly are the challenges? How can we address them? How do Bitcoin and other cryptocurrencies fit into this picture? And why do many experts agree that there is no way around a future built on blockchain and tokenization? These and other questions will be addressed here once a month from now on.

—

This article was originally published in Frankfurter Allgemeine Zeitung (FAZ) in German. For the original version, click here.

Disclaimer: The contents of the article reflect the private opinion of the author and not directly those of Deutsche Bank and DWS.