Tether: The most profitable business model in the world?

By Alexander Bechtel

Tether, the company behind the largest dollar stablecoin USDT, earned more than most major European banks last year. Does this make the issuance of stablecoins one of the most profitable business models in the world, or is there a catch?

Jean-Louis van der Velde is one of the most successful CEOs of recent years, although he is virtually unknown outside the crypto industry. Until December 2023, he headed Tether, the company behind the largest dollar stablecoin USDT. Stablecoins are blockchain-based tokens that have a stable value peg to a reference asset such as the dollar or euro. This should ensure price stability for an asset on the blockchain. By using blockchain technology, stablecoins enable digital transactions that can take place across borders and around the clock without dependence on traditional financial intermediaries. Their current uses range from trading cryptocurrencies to applications in the field of decentralized finance (DeFi), where they are used as a means of payment, settlement instrument and security. In the future, stablecoins could also be increasingly used in the traditional financial sector and in the real economy.

Tether generated a profit of just under 6.2 billion dollars with its stablecoin last year. By comparison, Deutsche Bank recorded a pre-tax profit of 5.7 billion euros (6.1 billion dollars) and Commerzbank 3.4 billion euros (3.7 billion dollars) in the same period. How does a company with only 80 employees manage to achieve such a net profit for the year?

The business model of stablecoin issuers such as Tether is simple: end users receive dollar stablecoins (in this case: USDT) by exchanging conventional, account-based dollars for USDT. Today, this exchange can be carried out primarily on crypto exchanges, where the USDT are then stored in a wallet. It can be assumed that traditional financial intermediaries will also offer such services in the future. PayPal already offers a wallet for both conventional dollars and stablecoins.

The conventional dollars received are invested by Tether in high-quality liquid assets (HQLA) – primarily US government bonds – and serve as a reserve for the outstanding USDT. This is to ensure that they can be repaid at any time. The secret behind the considerable profit is the interest income from the reserve, which can be retained by the stablecoin issuers. Often this interest even has to be retained. The European Markets in Crypto-Assets Regulation (MiCAR) expressly prohibits the passing on of interest by the stablecoin issuer to the end user.

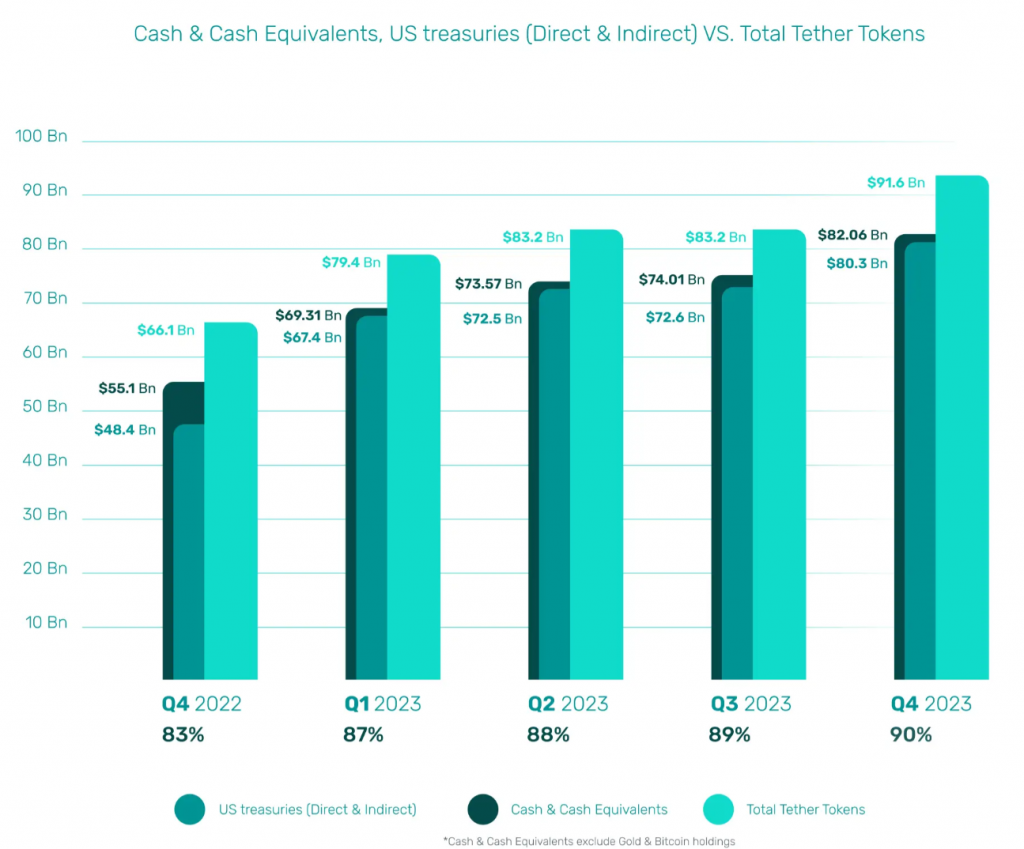

At first glance, this business model may seem tempting. However, it is unlikely that stablecoin issuers will develop into money printing machines in the future. Increasing regulatory interest in particular could stand in the way of such a development. In Europe, the MiCAR regulations for stablecoins will come into force in July 2024. Issuers of euro stablecoins must then not only be based in the European Economic and Monetary Union, but also have an e-money license. This will result in strict requirements for the collateralization of stablecoins. A reserve such as that held by Tether for USDT would probably not meet the European standard, as according to the auditor BDO, only 90% of outstanding USDT was covered by cash and cash equivalents or US government bonds on December 31, 2023.

The remainder was made up of riskier assets. These included gold, Bitcoin, collateralized loans, venture capital investments and other assets. Despite its excess reserves, Tether would probably not be able to demonstrate the minimum 2% CET1 capital required by MiCAR

The regulatory clarity in Europe has aroused the interest of traditional (financial) players. In addition to Société Générale in France, two prominent representatives of the German economy are also committed to stablecoins: SAP has been researching the usability of stablecoins for cross-border payments in cooperation with Circle – issuer of the second-largest dollar stablecoin USDC – since June 2023. And in December 2023, DWS announced that it was launching a joint venture called AllUnity together with European and American partners Galaxy Digital and Flow Traders with the aim of issuing a euro stablecoin as a Bafin-licensed company.*

In the United States, on the other hand, there is a lack of uniform regulation for stablecoins. However, the Chairman of the Finance Committee in the House of Representatives, Patrick McHenry, recently reported significant progress that could soon lead to a cross-party consensus.

Stablecoin expert Nic Carter from Castle Island Ventures believes that Tether is currently benefiting from the lack of regulatory clarity. Unlike its biggest competitor Circle, Tether’s headquarters are not in the United States. The company therefore largely escapes American supervision – at least in the perception of many users. However, this could prove to be a fallacy, as Tether has often come into conflict with the American law enforcement authorities in the past due to a lack of transparency and alleged false statements. In 2021, a settlement of 18.5 million dollars was reached with the Attorney General in New York. In addition, a penalty payment of 41 million dollars was made to the US regulatory authority CFTC.

Carter and other experts predict that regulated providers will ultimately gain the upper hand. One thing is clear: stablecoins can only prevail in the long term if they are issued by licensed financial institutions and report on the composition of their reserves with complete transparency. There must not be the slightest doubt about the exchangeability of stablecoins for account-based dollars or euros. Even if this may reduce the margins of stablecoin issuers, it is the only way to ensure the necessary trust of customers and regulators in the long term and to guarantee the stability of the financial market.

Tether’s current situation therefore appears to be a temporary phenomenon. It is questionable how long a dollar stablecoin issued by an unregulated institution outside the US can survive. In any case, Nic Carter’s forecast is sobering: Tether in its current form will no longer exist in three years’ time.

—

This article was originally published in Frankfurter Allgemeine Zeitung (FAZ) in German. For the original version, click here.

*Disclaimer: The author of this article is employed by DWS. The contents of the article reflect private opinions of the author and not directly those of DWS.