How a blockchain-based betting platform could influence the federal elections in Germany

By Alexander Bechtel and Jonas Koch

The forecasts on the blockchain-based betting platform Polymarket were impressively accurate during the US elections. The first forecasts for the German federal elections are now available. However, the platform operates in a regulatory gray area.

As Germany prepares for the federal elections on February 23, 2025, a new betting platform is shaking up the established world of opinion research institutes. Founded in 2020, the Polymarket platform has become one of the most important prediction markets for relevant events in politics, sport and society in just a few years.

Polymarket’s business model combines principles from the areas of betting markets, financial markets and blockchain technology. Users can bet on binary questions, for example: Will candidate X win the election? In contrast to traditional betting markets, bets can be bought and sold on Polymarket. This allows users to back up their assessments of political events with real money and the betting odds – which adjust in real-time according to the betting stakes – reflect the collective probability that the market attaches to a particular event.

Polymarket attracted particular attention with its precise predictions of the US presidential election. While traditional opinion research institutes were unable to identify a clear favorite by election day, Polymarket was able to predict a clear victory for Donald Trump well before the election. The platform estimated Trump’s chances of winning at 55% several weeks before the election, and as high as 67% on the morning of election day. In total, almost USD 3.7 billion was bet on Polymarket in connection with the US presidential election, more than on any other established betting market.

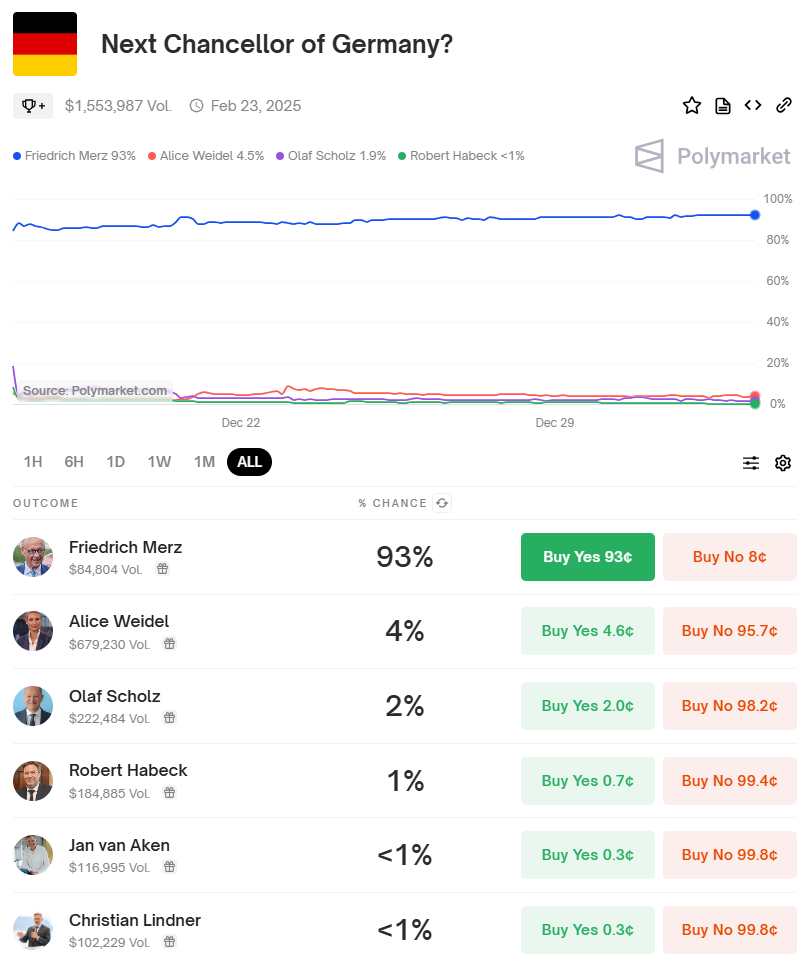

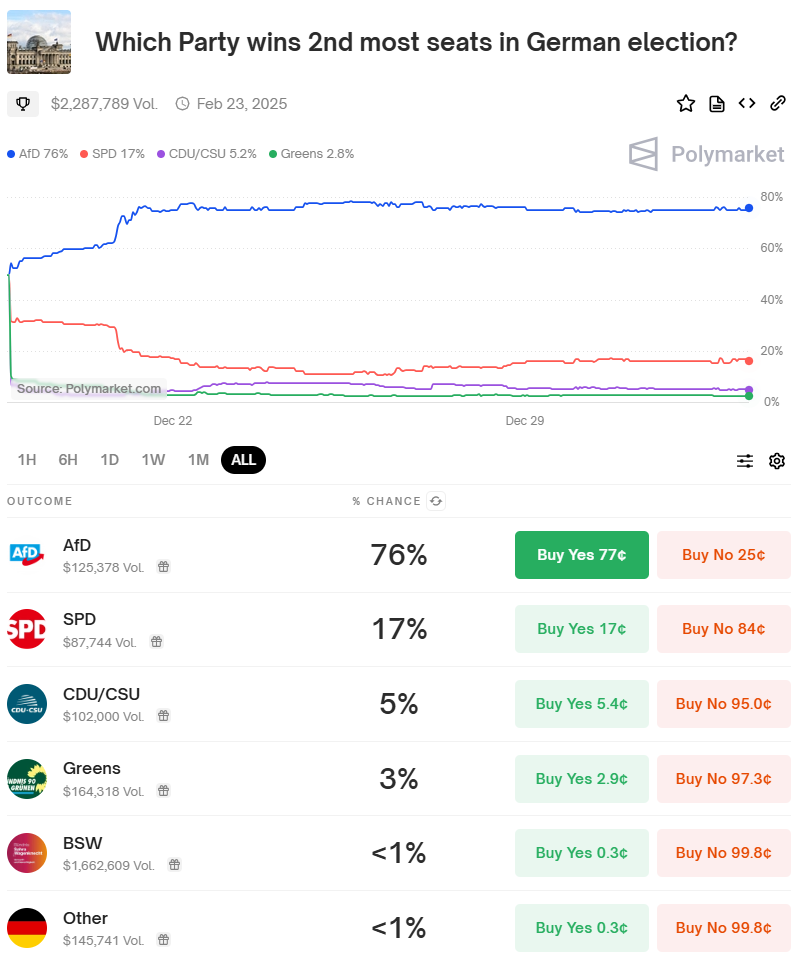

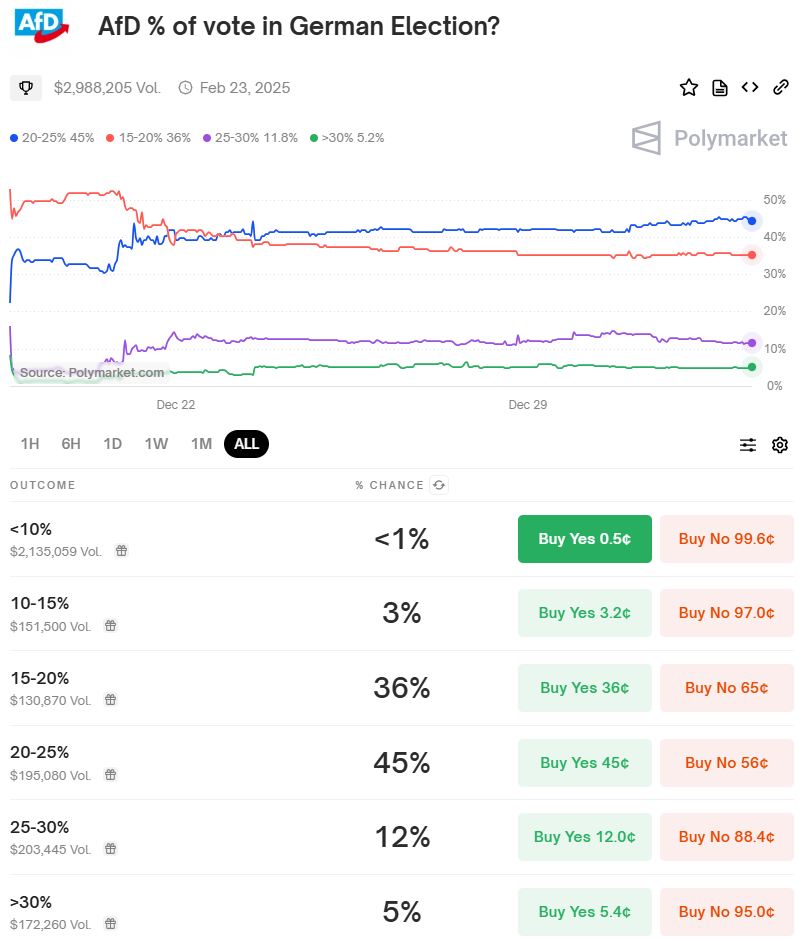

The stakes for the German general election are still in the low double-digit millions. Nevertheless, the first trends are already emerging: The betting markets on Polymarket are predicting a 93% probability that Friedrich Merz from the CDU will be the next chancellor. The AfD is a surprisingly clear favrotie to become the second largest party with a probability of 76%. It is expected to achieve an election result of 20% to 25%, which would roughly double its result of the last general election.

The weak position of the current governing parties is remarkable. The continuation of Olaf Scholz’s chancellorship is considered very unlikely with a probability of 2% – even Alice Weidel, the AfD’s lead candidate, is given a higher probability of success for the chancellorship. In some cases, the FDP is no longer even listed as an independent party in the forecasts, but is assigned to the “other” category.

Polymarket offers an innovative way of using collective knowledge in real time and deriving predictions for relevant events. However, the use of the platform operates in a regulatory gray area. The anonymity of users opens up opportunities for abuse and manipulation. In the USA, betting on Polymarket is prohibited, and it could also be classified as illegal gambling in Germany.

Particularly in small and illiquid betting markets such as those for the German federal election, odds could be distorted by targeted investments, thereby influencing opinion making. A few million US dollars are probably enough to influence the odds at present. This would be particularly problematic if Polymarket was to receive widespread media attention in the run-up to the election, as it has been the case in the USA. During the US presidential elections, the Polymarket odds were regularly picked up by leading media outlets and even disseminated via Bloomberg.

In such a situation, targeted betting on certain events would provide an opportunity to influence elections in Germany. The situation of Polymarket is therefore typical for digital financial innovations: The challenge is to exploit the efficiency benefits of the new technology without neglecting the necessary regulatory security standards.

—

This article was originally published in Frankfurter Allgemeine Zeitung (FAZ) in German. For the original version, click here.

Disclaimer: The contents of the article reflect the private opinions of the authors and not necessarily those of Serafin Asset Management and DWS.