AllUnity: the new stable standard

By Alexander Bechtel and Simone Conti

DWS, Galaxy Digital and Flow Traders launch AllUnity, a new euro stablecoin to promote the on-chain economy. This regulated stablecoin is intended to offer a trustworthy alternative in the global US dollar-dominated stablecoin market.

One of DWS’s core convictions in the area of digital assets is that significant parts of the financial industry will be tokenized in the future. This will lead to a fundamental change in the financial market infrastructure. In order to take a leading role in this changing landscape, DWS has been expanding its business to include products and services for the tokenized economy since 2022. In March 2024, Bitcoin and Ethereum Exchange-Traded Certificates (ETCs) were launched. Now, DWS is working on offering new services – in particular, support for the issuance and reserve management of stablecoins.

Fully regulated euro stablecoin

Against this background and following the introduction of the Markets in Crypto Assets Regulation (MiCAR), which creates a uniform legal framework for stablecoins in the EU, DWS has founded the joint venture (JV) “AllUnity”. Together with JV partners Galaxy Digital, a leading US digital asset company, and Flow Traders, one of the world’s leading market makers, AllUnity aims to issue a fully regulated euro stablecoin to drive the development of the on-chain economy.

In recent years, blockchain technology and the tokenization of assets and money have become increasingly important. The tokenized economy promises to increase the efficiency of financial markets – in particular by streamlining capital market processes. It also enables new applications such as native programmability, improved auditability and near-instant settlement in delivery-vs-payment transactions. Among the various use cases, the tokenization of money has emerged as the leader in terms of market capitalization, trading volume and user interest. The focus is particularly on issuing fiat currencies on blockchains.

Stablecoins: the money of the tokenized economy

Stablecoins are crypto assets whose price is linked to a reference value such as a currency or a commodity. Stablecoins linked to fiat currencies offer users a secure and stable means of payment for transactions in blockchain ecosystems. Various mechanisms are used to ensure a stable value. The most successful so far has proven to be the collateralization with high quality liquid assets (HQLA). Other stablecoins are collateralized by cryptocurrencies or rely on algorithms to maintain their value. However, the latter have lacked stability in the past.

In contrast to volatile cryptocurrencies such as Bitcoin and Ether, stablecoins aim to be a reliable means of payment, a stable unit of account and a secure store of value in the blockchain ecosystem. Fiat-backed stablecoins such as AllUnity achieve stability by being backed by fiat currencies (Euro) and corresponding Euro-denominated HQLA. For each stablecoin issued, AllUnity guarantees that a corresponding amount will be deposited with commercial banks or invested in HQLA. The aim is to give users the opportunity to exchange their stablecoins for the underlying fiat currency at par value at any time.

The global stablecoin market has seen impressive growth in recent years. Market capitalization rose from EUR 4.6 billion at the end of 2019 to EUR 152 billion in October 2024. To date, US dollar stablecoins have dominated the market with a share of more than 99.5 percent of total capitalization. They benefited from their pioneering role and were able to build liquidity and trust through network effects, which consolidated their dominance. The euro stablecoin market, on the other hand, is still comparatively small with a volume in circulation of around EUR 230 million.

Traditional finance and stablecoins

Initially, stablecoins were mainly used to facilitate cryptocurrency trading on centralized and decentralized platforms. They were used to price trading pairs on exchanges and enabled investors to earn passive returns in the decentralized finance (DeFi) space. Stablecoins have since established themselves as a cornerstone of the crypto markets. They act as a primary settlement asset, an important source of liquidity and a bridge between traditional financial systems and crypto markets. In the medium to long term, stablecoins offer considerable potential for broader applications in traditional finance. As “always-on” money, they enable seamless and programmable global payments and real-time settlements on public blockchains around the clock.

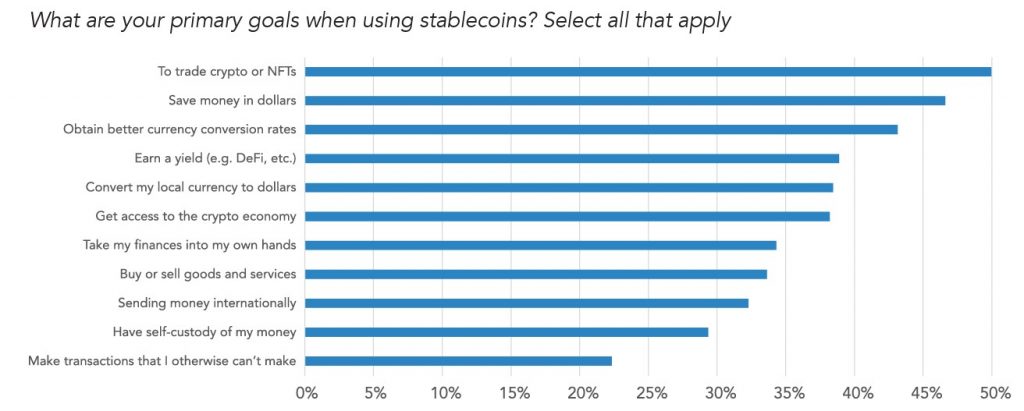

A recent survey by Castle Island Ventures and Brevan Howard Digital in five key emerging markets shows an increasing overlap between stablecoin usage and traditional financial applications. While cryptocurrency trading remains the most common use case at 50 percent, two traditional financial applications follow closely behind: Saving in US dollars (47 percent) and using better exchange rates (43 percent). Obviously, stablecoins are also increasingly establishing themselves in the traditional financial environment – in addition to their role in crypto markets.

The introduction of the Markets in Crypto Assets Regulation (MiCAR) creates uniform market rules for crypto assets in the EU. This allows AllUnity to launch its stablecoin in an environment of increasing regulatory clarity and improved investor protection. The particular advantage of a euro stablecoin backed and (co-)issued by DWS and its partners lies in the credibility and trust resulting from the involvement of established financial institutions. This is complemented by the expertise of leading partners in the field of digital assets.

Compared to US dollar stablecoins, AllUnity offers EU market participants the opportunity to trade with a blockchain-based euro. This simplifies deposit and withdrawal processes, eliminates currency risks and reduces counterparty risks to non-European players. With the regulatory clarity provided by MiCAR, AllUnity aims to capitalize on new market opportunities, drive growth and attract interest from institutional, corporate and retail users.

Euro-based stablecoins have potential

Stablecoins have established themselves as fundamental building blocks of the tokenized economy. They offer liquidity, stability and a bridge between traditional and digital markets. The euro stablecoin AllUnity, supported by DWS and its partners, aims to redress the existing imbalance in the US dollar-dominated stablecoin market and provide a trustworthy, regulation-compliant alternative in the EU.

With the legal clarity created by MiCAR, stablecoins such as AllUnity can drive growth and adoption by providing a seamless, euro-based solution for institutional and retail users. This development has the potential to improve market efficiency and further integrate digital assets into the traditional financial ecosystem in the coming years.